Agentic Lakehouse

for Financial Services

Complete Control. Unmatched Performance. Unified Access.

Accelerate AI-Driven Analytics While Maintaining Data Sovereignty

Financial Services Companies Who Trust Dremio

Use Cases for Financial Services

Financial institutions face unprecedented data complexity and sovereignty requirements that hamper decision-making and regulatory compliance across multiple jurisdictions.

Data Silos

and Complexity

Fragmented data across core banking systems, transaction databases, risk platforms, and customer touchpoints creates operational chaos.

- Inconsistent reporting across business units

- Delayed insights for time-sensitive decisions

- Manual data reconciliation processes

- Duplicate data storage costs

Data Sovereignty and Jurisdictional Control

Financial institutions must maintain strict control over data location and jurisdiction while meeting regional regulations across multiple countries and data residency requirements.

- Complex multi-jurisdictional compliance requirements

- Data residency and sovereignty mandates

- Cross-border data transfer restrictions

- Regional regulatory variations (GDPR, CCPA, etc.)

Performance

and Scale Demands

Modern financial analytics require real-time processing capabilities, but traditional systems are hard to scale and require lots of manual and error-prone efforts to achieve performance SLAs.

- Slow fraud detection response times

- Manual tuning and optimization overhead

- Error-prone scaling processes

- Inability to meet performance SLAs consistently

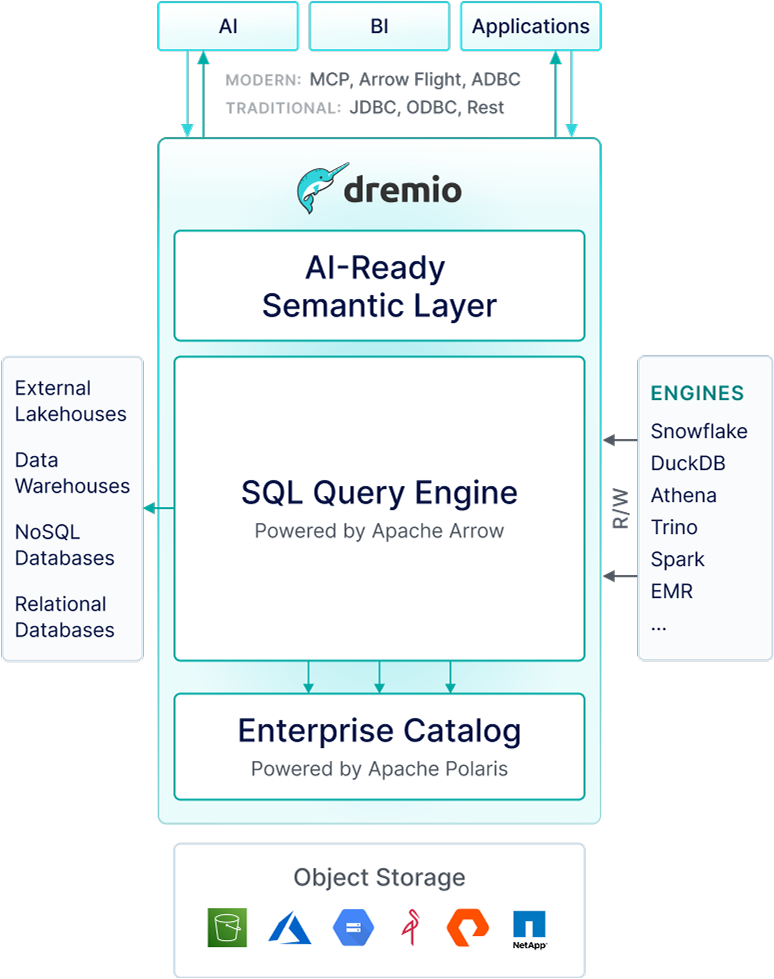

The Agentic Lakehouse Platform

Dremio provides the AI-enabled semantic layer, intelligent query engine, and open metadata

catalog required to win in the AI era.

Why Dremio for Financial Services

Accelerate AI and analytics for fraud detection, risk management, and customer lifetime value analysis with Dremio's Intelligent Lakehouse Platform. Ensure governance, security, and self-service flexibility across hybrid environments.

Data Sovereignty & Control

- Maintain complete control over data location and jurisdiction

- Ensure GDPR, PCI DSS, and Basel III compliance

- Centralized governance with audit trails

- Complete data lineage tracking

- Full Jurisdiction Control

Fastest Lakehouse Platform

- Sub-second query performance at scale

- Autonomous optimizations and intelligent caching

- Industry's fastest SQL engine built on Apache Arrow

- Optimized for financial analytics workloads

- 10x Faster Performance

Hybrid Federation

- Connect on-premises, cloud, and hybrid environments

- Query across AWS S3, Oracle, Snowflake, and legacy systems

- Real-time data federation without data movement

- Break down silos with unified data access

- Zero Data Movement

Financial Services Use Cases

Discover how leading financial institutions are transforming their operations with Dremio's intelligent lakehouse platform.

Fraud Detection

Unlock the fraud detection process by combining real-time transaction logs with customer data. Reduce fraud losses and enhance security using AI-powered analytics.

Risk Management and Compliance

Ensure compliance with global regulations like PCI DSS and Basel III by leveraging governed analytics to analyze credit exposure, liquidity risks, and operational vulnerabilities.

Nomura modernized its data lake delivering efficiency with Dremio Unified Lakehouse Platform to enable massive workload scaling.

Hyper-Personalized Banking

Deliver tailored financial products by analyzing unified customer profiles across CRM systems, apps, and branches in real time using AI-driven segmentation.

FactSet modernized applications with Dremio, accelerating access to financial data by 20x for better investment decisions.

Portfolio Analysis

Empower analysts with instant access to portfolio data for smarter investment decisions using unified views of market trends and risk assessments.

TransUnion unified secure analytics for 1B people in 30 countries, expanding credit to 149M consumers via Dremio’s lakehouse.